When you own or even start a business, you must have expertise up your sleeve for your company or venture to operate successfully. For instance, if you run a restaurant business, you should be adept at cooking and food. However, you might not have the skills to manage your finances effectively.

How can a financing software help you?

カヴァン・チョクシ is a highly successful entrepreneur fond of travel, photography, and technology. He is a business expert and has valuable experience in the field. When it comes to effectively manage business finances, he recommends one should optimize finance software to gain expertise in taxes, accounting, and budgeting. There are several credible software platforms available in the market, and you can choose one that syncs in with your business needs with success!

You also have the option to outsource these tasks to a skilled accountant or bookkeeper; however, make sure the professional is familiar with the financial basics of your business.

Educate yourself about small business financial management

As a business owner, you should educate yourself about business financial management. You will find several good courses locally and online. If you are a small business owner, these courses help you to gain expertise in the subject in a large way. Often, a small business cannot afford to keep an extensive accounting department; if you, the owner of your company, learn the basic skills of book-keeping and accountancy, you are able to manage finances yourself. Later, with time, when your business grows and expands further, you can always invest in a good accountant to take care of your internal business financial needs.

Building business credit for your enterprise

One common mistake most business owners make of small to medium scale companies is to mix their personal and business finances. You should avoid doing this. There are many advantages of creating a unique financial identity for your business. When you build business credit, you are able to attract financing for your company better. Moreover, suppliers will also offer you better deals and terms with contracts.

Keep the following in mind-

- Ensure you have the proper legal setup. If you are a sole proprietor, consider setting up an LLC.

- Get a tax identification number.

- Open a separate bank account for your business.

- If you do not have a business credit card, get one.

- Pay your bills immediately and apply for valuable lines of credit from your vendors.

According to カヴァン・チョクシ, you should have an effective system for billing customers and clients. If your business issues invoices for its services given, you will suffer from cash flow issues, mainly because clients will pay late. You cannot eradicate this issue completely; however, you can reduce them by having an efficient and clear billing strategy. This will streamline the cash flow and eliminate potential cash flow problems for your business.

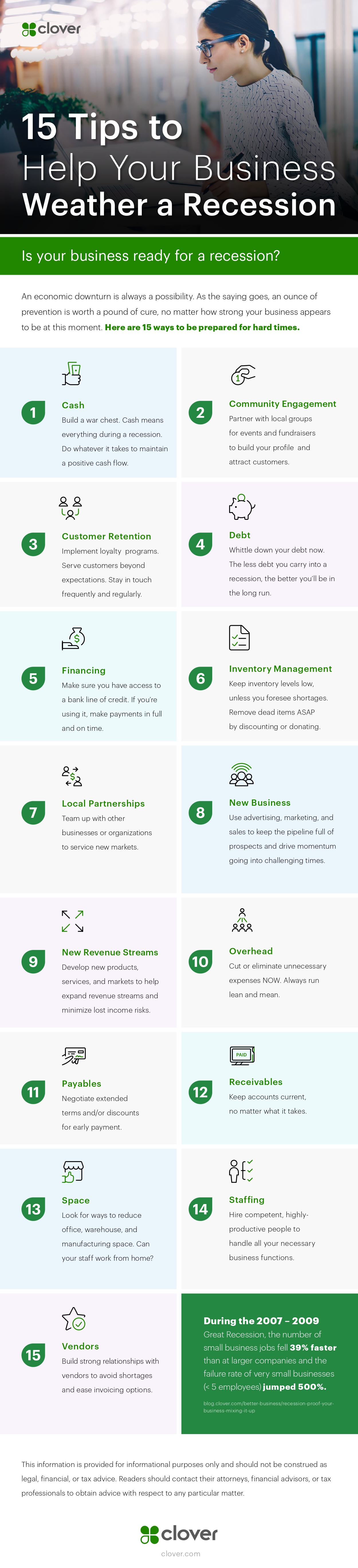

Infographic created by Clover, a payment processing company